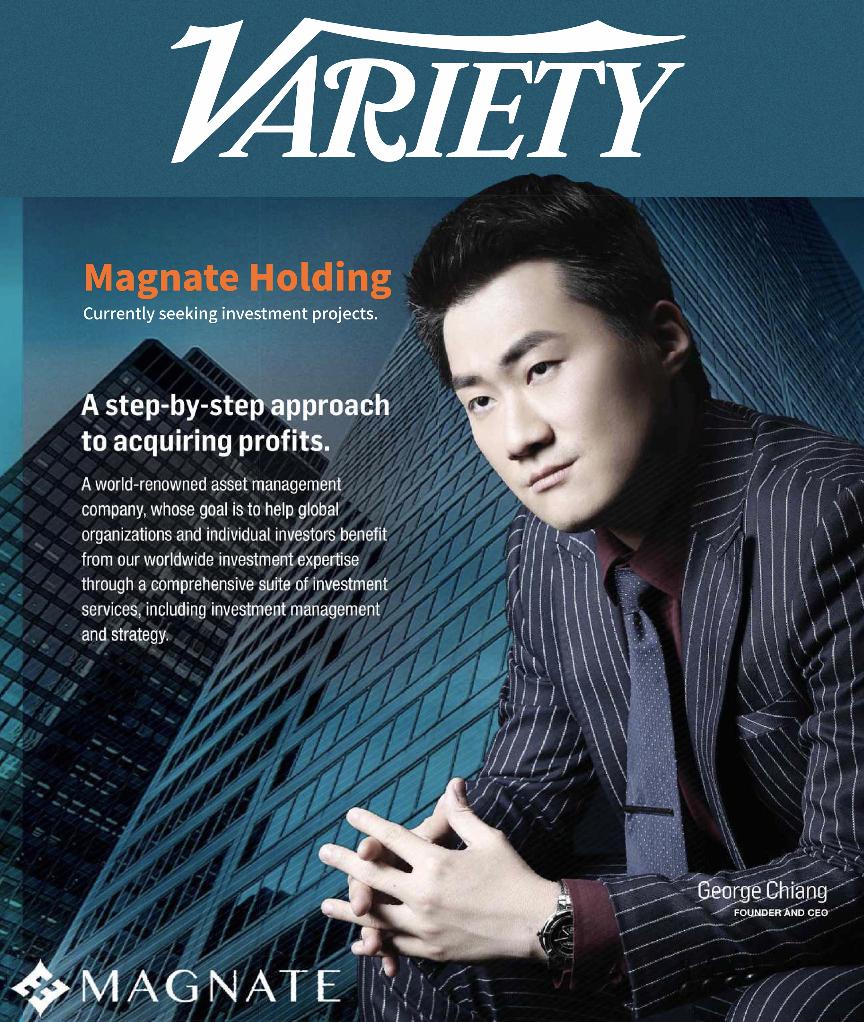

鉅亨國際總裁姜建亨登上了好萊塢權威影視雜誌《Variety》封面,成為《Variety》創刊百余年以來,第三位登上好萊塢權威影視雜誌封面的中國企業家。

《Variety》作為好萊塢最權威的影視風向標雜誌,擁有超過百年的海量專業信息背景,是目前全球行業人士獲取娛樂與媒體專業新聞的必備參考讀物。從某種程度上而言,《Variety》影響了好萊塢電影圈的投資與拍攝。

除了登上雜誌封面之外,《Variety》雜誌此前還對鉅亨國際總裁姜建亨就相關投資領域進行了采訪,具體報道如下:

Magnate Holding Brings Chinese Investment to Hollywood.

Abstracts:A foreign investor in the latest Transformers lm, Magnate Holding, led by billionaire CEO George Chiang, has created a Culture and Entertainment Fund to connect Chinese investors with entertainment projects in the U.S.

LOS ANGELES, CALIFORNIA – September 20, 2017 – Chinese investors are becoming an important new source of Hollywood funding, while the Chinese box office is now one of the most critical factors in a big-budget lm’s profitability. Recently, the Hollywood movie Transformers: The Last Knight scored an impressive $41 million opening day in China, helping lead the overseas box office numbers. Foreign investor Magnate Holding attended the lm’s global premiere in Guangzhou, China, becoming a focus of the media coverage. Now the company is seeking to make further investments in Hollywood through its Culture and Entertainment Fund.

Founded in 2008 in Taipei,Taiwan, Magnate Holding is an asset management company that originally focused on secondary market and pre- IPO investments. The company has vast experience in private stock investment in both China and overseas markets. Its investment portfolio includes a Real Estate Fund, Automobile Finance Fund, Overseas Tourism Fund and the aforementioned Culture and Entertainment Fund. Magnate Holding’s fund categories are known for their variety, low risk and high profitability. A leading company in the fund industry, the company began investing in the American movie industry in 2012, starting with independent films. In 2017, Magnate led Chinese investors across the globe to participate in stock investment and global pro t sharing for Transformers: The Last Knight.

The founder and CEO of Magnate Holding, George Chiang, 30, has become the subject of much of the media focus. Having made headlines in Taiwan for his stock market savvy while still in junior high, Chiang is known for increasing his personal assets 17-fold by the time he entered college just five years later. The image of him as a young and promising “stock wizard” was widely publicized across Asia, leading him to found Magnate Holding in his early 20s. Several years after completing extension classes at the University of Southern California in Los Angeles, Chiang collaborated with the city of El Monte, California, to host the inaugural Lunar New Year Fireworks Show and promote Chinese culture in America. He holds the distinction of being one of the world’s youngest self- made billionaires.

“The biggest obstacles for Chinese investors are the restrictions placed on foreign Exchange Control in China, in addition to the disparities in information and culture between the U.S. and China,” said Chiang. “What’s missing for Chinese investors looking to invest in Hollywood is ideas, not opportunities. At the same time, without clear market data, Chinese investors won’t have much success with lm projects.” As a result, Magnate Holding helps Chinese investors establish accounts, manage foreign asset allocation and invest in pro table projects based on the company’s extensive overseas investment experience.

Chiang also cites other trends at work. As global and Chinese economic development has weakened, asset allocation profits have also decreased in many cases. Financial products managed by banks, bonds, funds, trusts and stocks, as well as web-based financial products, have seen their profitability diminished. Simultaneously, China has entered an era of shortages in asset allocation. “Chinese capital leaving the country has become the norm,” said Chiang. “It’s also an important trend for asset upgrades.

We truly believe the power of capital can push the entertainment industry forward more effectively.”

To achieve this goal, Magnate Holding partnered with two of the most secured banks in Asia – DBS serves as the custodian bank in Singapore, while TMF Group is the trust custodian in Hong Kong – to establish the Culture and Entertainment Fund. With its mature trust fund model, it helps Chinese investors participate financially in Hollywood as well as the American real estate market in a more secured and less risky way. The company aims to further the cooperation between the two countries and make project financing smoother.